If an investor wants tax advantage growth what should he do? Municipal bonds are worth considering for situations like this. They provide tax-free growth and can be an ideal place to save your money for golden days.

Municipal Bonds are securities issued by local governments or by other governments to finance capital projects such as constructing highways or sewers. Due to this reason, the investor does not have to pay tax on interest payments.

According to statistics, the municipal bond market is worth $3.8 trillion. This makes municipal bonds attractive investment options for high tax brackets.

Types Of Bond You Need To Know About:

There are mainly three types of bonds as mentioned by exchange commissions.

- General Obligation Bond

This type is the most common one that is based on the issuer’s full faith and credit. It consists of 60% of the total bond. It is the most secure one and the investor pays them using current tax revenues.

- Revenue Bonds:

The remaining part of the bond is the revenue bond. It comprises 40% of the total. This type of bond is for highways, sports arenas and sponsored development of the city. This bond generates revenues for the above projects. These are not backed by the government.

The third type of bond is issued sometimes on behalf of private entities. The municipality just sells the bond and is not a reliable one because there is a chance that the borrower will not pay.

How Municipal Bonds Work:

For investors who need a tax-free revenue system, municipal bonds work the best. It works in a way that twice a year bondholders must pay interest to investors. Simply, bondholders lend money to bond issuers alone. The issuers must pay back the money when the maturity date of the bond comes. The bond issuer pays the interest until the last date that is three years for short term bonds and 10 years or more for other bonds.

These bonds are available on the municipal bond seller or through municipal bond funds. But you need to check whether these sources have gone through registration or not.

How To Know About Their Rate

The rate of municipal bonds depends on three main factors.

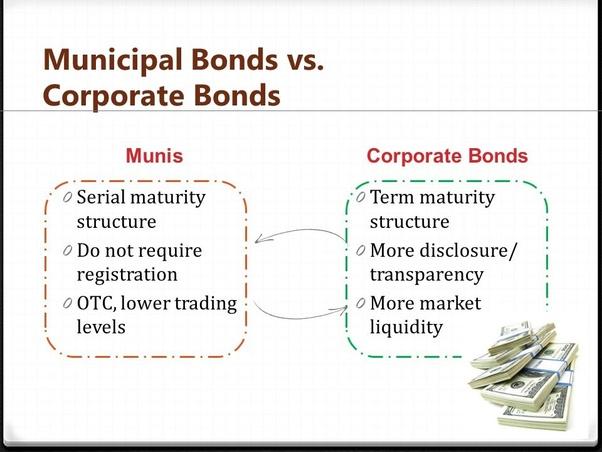

Firstly, most bond rates are decided based on equivalent treasuring bond yield. These bonds are issued by the Federal government and are risk-free. On the contrary, munis bonds have a more risk so they have higher rates than federal bonds.

According to Angela Marie Kovacs, credit rating is the most important one. The highest rating till now is AAA. They are more secure and safest. If a bond has a higher credit value its rate will be low but if its credibility is low the rate will be high to compensate for default.

Lastly, the yield will be more if a bond has a longer maturity time say 30 years than those of less maturity time. It is the preferred one because investors want tier money to be safe and to yield for a longer time.

How To Buy It?

You can buy these bonds from the bank, municipality office or your financial advisor. You can consult it on the website of Electric Municipal Market Asses. They will give you information about the types of bonds, their yield and maturity time. You can know about the pros and cons of using bonds and audited financial statements. If you want to buy many bonds this pace is the right one.

Posing Threats:

A study conducted by Federal Reserve Chairman Paul Volcker titled “Final Report of the State Budget Crisis Task Force.” In 2014 put forward some risks and flaws associated with this system. They presented some threats posed by this system of bonds. These are:

- The largest part of the state budget is Medicaid. These costs will cross over state revenues which will cause a problem.

- Current operating costs of cities and counties are handled using bonds issued by states.

- Also, to cover operating costs of these bonds many states are selling their assets which is not a good thing to do.

- States raise taxes or cut benefits to provide employee pensions because these funds are not enough to guarantee payout to retires.

Because of this, cities do not have enough money to start new influential projects or even face difficulty in supporting education and other services. This was all about municipal bonds. If you want to buy one, make sure it is registered.